About Digido Loan

Loans have often been misunderstood and labeled negatively due to prevalent misconceptions. However, they can significantly alleviate financial stress and help you achieve your goals when managed properly. The key to benefiting from loans lies in exercising financial discipline.

Traditionally, banks have been the go-to for loan products, but their stringent requirements and processes have made them less accessible. In response to the demand for more convenient and accessible options, online loan platforms have emerged. These platforms cater to individuals who lack access to traditional banking services, offering quick and hassle-free cash assistance, especially in emergencies.

When managed correctly, loans can not only address immediate financial needs but also pave the way for financial independence. Online loan providers like Digido are designed to provide these services efficiently. Here’s a review of Digido to help you determine if it can meet your financial needs.

Summary of Digido Online Loan Philippines

| ✅ DIGIDO PH Official website | www.digido.ph |

| ✅ Loan Amount | Ranging from 500 to 30,000 Pesos |

| ✅ Age Eligibility | 21 to 70 years old |

| ✅ Loan Term | 3 to 6 months |

| ✅ Interest Rate | Monthly 11.9% |

| ✅ Special Offer | First loan with 0% interest rate for 7 days |

| ✅ Requirements | Filipino Residents |

| ✅ income | Employed individuals and selected professionals |

| ✅ Repayment Options | Bank transfer, GCash |

| ✅ The Pros | Legitimate, minimal complaints |

| ✅ The Cons | Unpaid loan fees |

| ✅ Effectiveness Rating | Good |

| ✅ Bad Credit Acceptance | Allowed |

| ✅ Contact Number | +63 2 8876 8484 |

| ✅ Complaints | None reported |

| ✅ Harassment | Only by telephone |

| ✅ SEC Registration Number | CS202003056 |

What is Digido Loan?

Digido Loan is a modern digital lending platform designed to meet the financial needs of individuals and businesses through swift and accessible online services. With its user-friendly interface and efficient loan processing, Digido has quickly established itself as a prominent player in the online lending market.

Is Digido Legit?

Digido Loan is a legitimate lending platform. Digido Finance Corp is registered with the Securities and Exchange Commission (SEC) of the Philippines, holding a registration number CS202003056 and a Certificate of Authority number 1272. This registration ensures that Digido operates within the legal frameworks set by the government .

Moreover, Digido has a physical location that enforcement authorities can visit if necessary: Digido Finance Corp., Units P107003R, P107007R, P107008R, Level 7 Cyberpark Tower 1, 60 Gen. Aguinaldo Ave., Cubao, Quezon City, Philippines 1109.

Is Digido a good loan?

Advantages

- Quick and Automated Process: Digido offers a fully automated loan application process, allowing borrowers to receive funds in as little as 15 minutes .

- No Hidden Charges: The platform is transparent about its fees and charges, ensuring that borrowers are fully aware of their repayment obligations before committing to a loan .

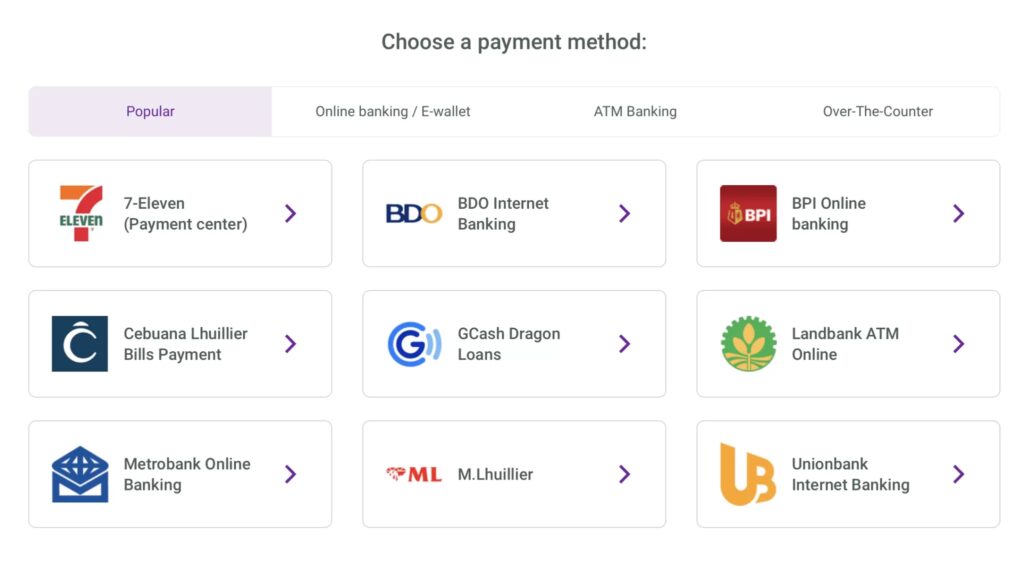

- Flexible Repayment Options: Digido provides various repayment channels, including online banking, e-wallets like GCash, and cash payment centers such as 7-Eleven and Cebuana Lhuillier, making it convenient for borrowers to repay their loans .

- First Loan Interest-Free: For first-time borrowers, Digido offers an interest-free loan, making it an attractive option for those needing immediate funds without additional costs

Disadvantages

- Data Privacy Concerns: There have been reports of personal data being compromised, leading to spam calls and messages, raising concerns about data privacy

- High Interest Rates: Digido’s interest rates can be quite high, particularly for subsequent loans. For example, a loan of PHP 20,000 with a 4-month term can have a monthly interest of 12%, resulting in significant interest payments over time

- Potential for Hidden Charges: Some users have reported unexpected fees and higher-than-anticipated repayment amounts due to daily interest accruals, emphasizing the importance of thoroughly reading the loan contract .

- Customer Service Issues: While many users report positive experiences with Digido’s customer service, there are also complaints about unprofessional behavior and harassment from customer service representatives

Loan Amount and Loan Terms

Digido loan terms are flexible at three, four, five, and six months. The loan amount is also decent, ranging from ₱1,000 to ₱25,000.

Specifically, if you’re a first-time borrower, you can apply for a loan amount anywhere between ₱1,000 and ₱10,000. The more you use Digido, the higher your loan amount gets, eventually entitling you to a Digido maximum loan of ₱25,000.

Use the Digido loan calculator to choose the right loan amount and duration that best fit your needs. Just take note that Digido’s eligibility criteria and loan requirements may vary depending on the loan amount and duration.

Interest rate and Fees

Interest Rates

- Digido typically charges a daily interest rate ranging from 1% to 2.5%.

- The annual percentage rate (APR) can be quite high due to the compounding nature of the daily interest rates.

Fees

- Service Fees: There may be a processing or service fee deducted from the loan amount.

- Late Payment Fees: If you miss a repayment, late fees can apply, which might be a fixed amount or an additional percentage of the overdue amount.

- Extension Fees: If you need to extend your loan term, additional fees might be applicable.

Special Offer

Get first loan with 0% interest rate for 7 days

Eligibility and Application Process

To be eligible for a Digido loan, applicants must be Filipino citizens aged 21 to 70, with a stable income. The application process involves submitting personal information and valid ID, with the option to provide additional documents to increase approval chances.

How to Apply for a Loan

Apply Through the Website

Applying through the website Digido.ph follows the same steps as applying through the mobile app. Just go to the website and use the loan calculator to enter your preferred loan amount, then follow the rest of the steps as indicated in the previous subsection.

Just take note that using the mobile app is more recommended as it gives you access to extra funds up to ₱1,000. The approval rate is also higher when you use the app.

Apply Through the Mobile app

Here’s a step-by-step guide to applying for a loan using the Digido loan app:

- Download the App:

- For iOS: Go to the Apple Store and search for “Digido loan app.”

- For Android: Go to the Google Play Store and search for “Digido loan app.”

- Download and install the app on your device.

- Open the App:

- Launch the Digido loan app on your device.

- Indicate your preferred loan amount.

- Enter Your Mobile Number:

- Provide your mobile number in the designated field.

- Review Policies and Terms:

- Carefully read the privacy policy, terms and conditions, and consent form.

- Check the consent box if you agree to the terms.

- Click ‘Apply Now’:

- Click the “Apply Now” button to proceed to the account creation form.

- Confirm Your Mobile Number:

- Enter the confirmation code sent to your mobile device to verify your number.

- Upload Identification Documents:

- Upload a valid government-issued ID and any other required supporting documents.

- Specify Loan Disbursement Method:

- Indicate how you would like to receive the loan proceeds (e.g., bank transfer, e-wallet).

- Wait for Assessment:

- Wait for the automated system to assess your application. This may take a few moments.

- Confirm the Loan Contract:

- If your application is approved, you will receive a confirmation code on your device.

- Enter the confirmation code to confirm the loan contract.

- Receive Loan Proceeds:

- The loan amount will be transferred to you in real time based on your preferred disbursement method.

How to repay a Didido loan

Select your preferred repayment method. Digido usually offers multiple repayment options such as:

- Payment centers (like 7-Eleven, Cebuana Lhuillier, or M Lhuillier)

- Bank transfer

- E-wallet (like GCash or PayMaya)

- Online payment gateway

Final Thoughts

Digido offers a range of benefits, making it a viable option for those seeking quick and convenient loan services. However, it’s important to weigh the pros and cons before making a decision. It’s crucial to read and understand all terms and conditions before proceeding with a loan to avoid unexpected charges and ensure a smooth borrowing experience

Share